Bringing You Euro as a Service

Redeem EURS for free Total Value Settled: 5 billion+ settled on-chain

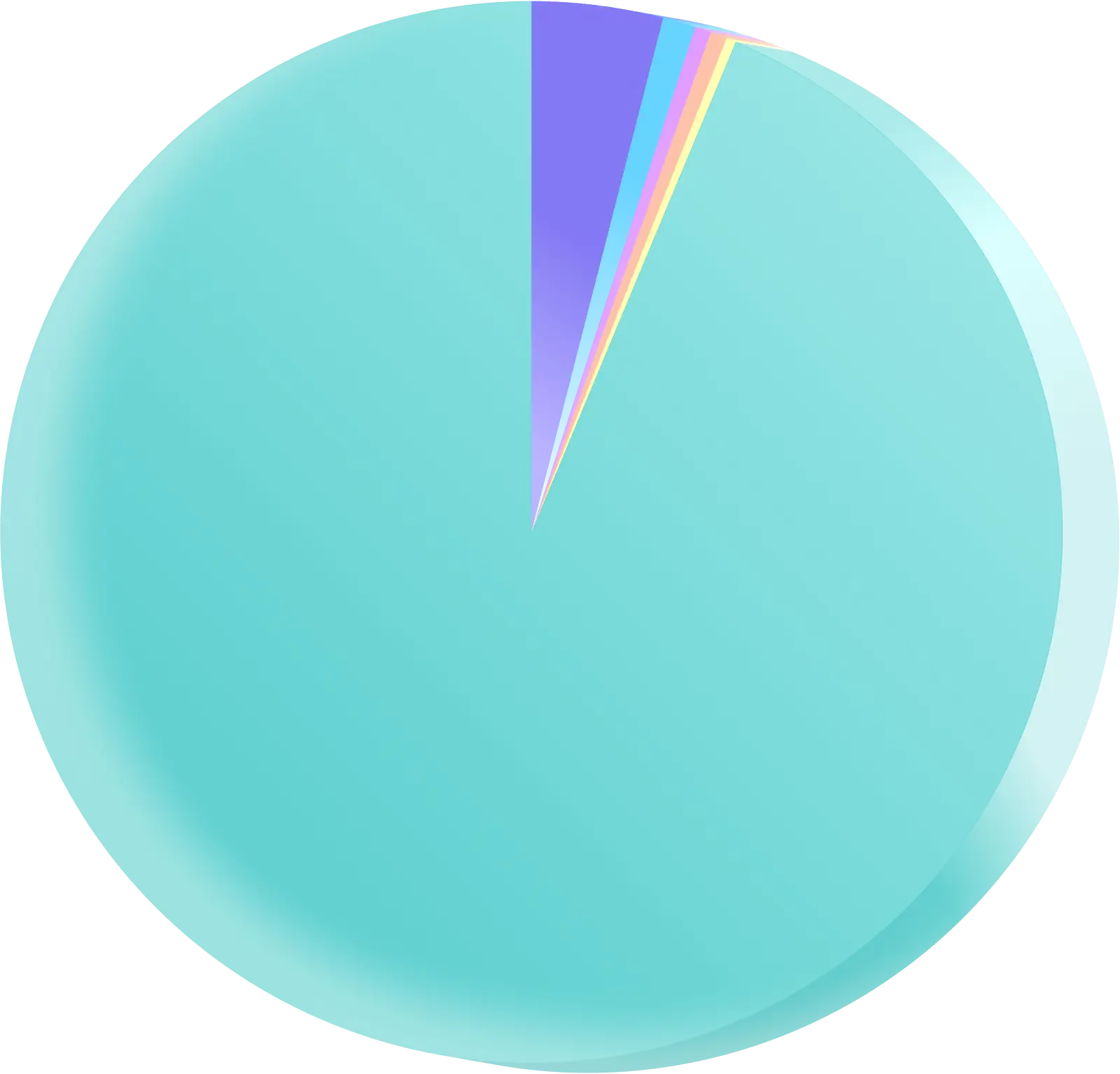

EURS amount in circulation:

114 180 617 EURS

EURS Across Settlement Layers

Allocation

Ethereum L2 ARBITRUM

12795.04

XDC Network

0.00

Ethereum L2 xDAI

2228.90

ALGORAND

65163.00

STELLAR

-20486.00

Ethereum ERC-20

114125940.00

Ethereum L2 MATIC

3889835.71

XRP

10000.00

STASIS aims to ensure EURS flexibility to avoid inefficiencies of the single-layer solutions. We aim to unleash the full potential of distributed ledger technologies for our stablecoin and adapt to what's coming ahead.

What is

EURS?

EURS?

EURS is the largest euro-backed digital asset, combining the benefits of the world’s second most traded currency with the transparency, immutability, and efficiency of the blockchain.

Our stablecoin is supported by an ecosystem of liquidity providers, custodians, exchanges, payment platforms, and others.

EURS, an ERC/EIP20 token, is the first stablecoin to introduce delegated payments on the Ethereum network.

Users no longer have to pay GAS fees to make transactions. Instead, they can pay transaction fees in EURS or any other digital asset supported by the STASIS wallet, which is a huge improvement in user experience.

Still Got Questions About How to Use EURS?

For Press

Our PR team is here to help with STASIS-related press and media inquiries, stablecoins, and DeFi. Our executives have considerable financial, technological, and regulatory expertise and can offer insight into a range of industry topics.